Menu

About us

- 60 Years in business

- 2,000 Clients

- 50 State TPA

- 13 Years avg client relationship length

- 45-3,000 Group size

Our advantage

BeniComp IncentiCare is the only healthcare plan in the country that is able to implement an effective way to reduce spending while improving the health of your employees. Our health improvement program averages a 96% participation rate.

Because we can identify the members at risk for serious health issues, we proactively reach out to them and help them improve their health, while reducing the financial risks associated with potential health issues.

See how much you can save

What is included

Medical management

Our in-house nursing staff provides case management

Telemedicine

Members can access telehealth via video or phone call 24/7

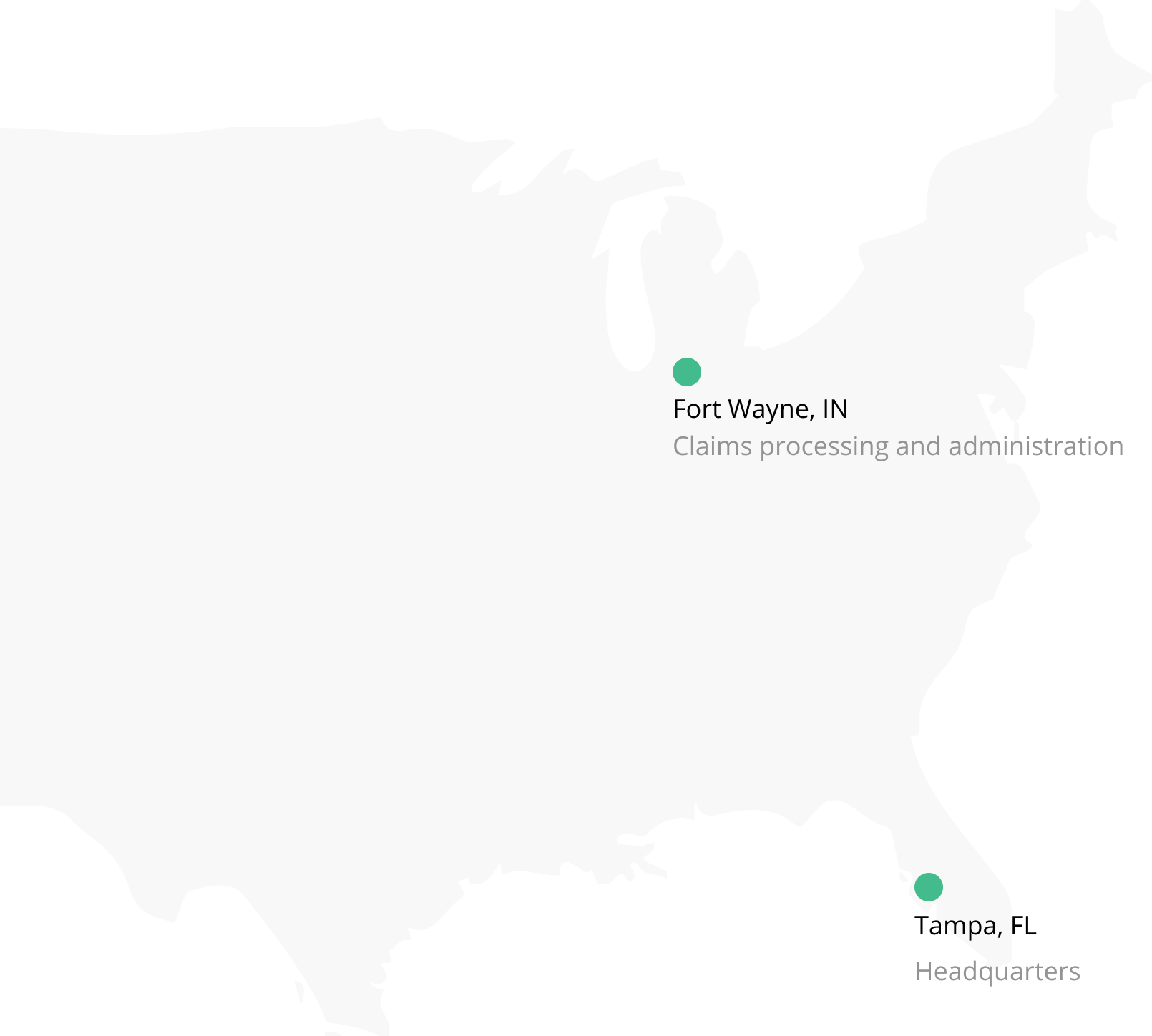

Claims processing

We provide:

- TAT statistics

- Auditing %s and ratio of accuracy

- Weekly payment of claims with invoicing and check run

Customer service

Members can connect with our support staff easily through:

- Chatting in the BeniComp Portal

- Creating support tickets

- Submitting unexpected medical bills for review

Preventive health management

In-house health coaches proactively reach out to members with poor health screening results. Access to health coaching is free for the members.

Reporting

We generate unique reports that blend data and graphics, so you can get a clear understanding of how the plan is doing.

Search

Search!